🐒🐒 R Time Series Issues 🐒🐒

Table of Contents

- the end of R will not be messy … it will be tidy

- reproducibility

- when is a matrix not a matrix

- artificially sweetened intelligence

- when is the intercept the mean

- R you drifting?

- wrong p-values

- lead from behind

- regress this

- you’re ugly

- don’t run this example - or ELSE!

🐒🐒🐒🐒🐒

We’re back at trying to help users get past the gnarly stuff that comes with trying to use R for time series. This is an update of the R Issues Page wherein it was written, on whatever they write it on up there:

There are a few items related to the analysis of time series with R that will have you scratching your head. The issues mentioned below are meant to help get you past the sticky points.

Many of these issues have been taken care of in the package astsa. An introduction to the package may be found at FUN WITH ASTSA where the fun never stops. 🎈 🎈 🎈

- Before we start:

Definition: Vanilla R Packages chosen by the developers that are automatically loaded when R is started.

✨ The Front DooR if you need to find your way home.

Issue - how will R end?

The issue below has become a real pain as the commercial enterprise that makes RStudio influences the R Foundation, which is a nonprofit organization. Older folks saw this happen with R’s predecessor, S and S-PLUS. Anybody using S-PLUS right now?

The issue below has become a real pain as the commercial enterprise that makes RStudio influences the R Foundation, which is a nonprofit organization. Older folks saw this happen with R’s predecessor, S and S-PLUS. Anybody using S-PLUS right now?

In fact, we fully agree with Norm Matloff’s essay 💩💩💩 posit & the enshitification of R 💩💩💩 . Because of it, we have to put warnings in our texts so that beginners don’t get sucked into the mess  . Along the lines of the enshitification of Splus, why didn’t POS(it) design their own software instead of leeching off of R?? Because it would have gone nowhere… it’s what parasites do, feed off of others. Norm puts it this way:

. Along the lines of the enshitification of Splus, why didn’t POS(it) design their own software instead of leeching off of R?? Because it would have gone nowhere… it’s what parasites do, feed off of others. Norm puts it this way:

An open-source project involves people spending a large amount of time developing the project for free, no pay. Thus, for a commercial entity to then swoop down and exploit all that free labor for its own profit is fraught with peril. To then take over the product as its own is unconscionable. I have no doubt that RStudio was well-intentioned in this, sincerely believing in the Tidyverse, but many do not share this view, and RStudio should have worked with the R Core Group, rather than taking action on its own.

💩 Our problem started with an issue that was a conflict between the packages dplyr and stats. The problem came to our attention via online complaints and confusion from students who were taking a time series course and a data analysis course at the same time. The main problem was/is with filter() and lag(). There are more conflicts out there, but this conflict can ruin your analyses.

The bottom line is, if you are working with time series and you load dplyr, then you should know what it breaks… just be careful.

In fact, you should be careful whenever you load a package. For example:

# if I do this

library(dplyr)

# I will see this

Attaching package: 'dplyr'

The following objects are masked from 'package:stats':

filter, lag

The following objects are masked from 'package:base':

intersect, setdiff, setequal, union

## it's a package fight!

How this is allowed is beyond me  no package should be able to annihilate Vanilla R. Perhaps the designers of the tidyverse could have used

no package should be able to annihilate Vanilla R. Perhaps the designers of the tidyverse could have used dfilter and dlag instead?? (Filter is a base script - we used to suggest that as an alternative but we wouldn’t want to corrupt a base script, right? )

⭐⭐⭐⭐⭐

Ok- so this particular rant is NOT about pipes, if you think mydata |> plot() is better than plot(mydata), then we’re happy for you (not really - we think you just joined a cult). This is about corrupting nice base scripts like filter and lag and making our work as instructors so much harder 🖕. If the conflicted package were made part of base-R, that would be a step in the right direction, but novices would still have a hard time… it’s still best if MASKING BASE-R IS NOT ALLOWED.

It’s often useful to take things to extremes to see if they make sense at a lower level. For example, could I change things like + and so on?? So if you load my package, say screwu, this would happen:

library(screwu)

The following are masked from 'package:base':

+, -, *, /

# now try

1 + 1

[1] 0

# ... no no dumbass, you have to do this

1 base::+ 1

[1] 2

# see, it's not a problem...

We would say avoid loading dplyr if you’re analyzing time series interactively (the advantage of using R vs batch mode programs) or fix the problem using the info below. And generally, to be safe, load packages consciously and watch for masked objects warnings.

For f*ck sake, after reading Norm’s essay, it seems clear that dplyr is a MUCH slower and weaker version of data.table. So don’t be a ᑎᑌᗰᗷ ᑎᑌT and stop subscribing to posit’s enshitification of R, and try data.table if you have to do data science.

AND, when you load data.table, there are ZERO masked warnings!!! And maybe we can stop having to put warnings about dplyr everywhere for time series analysts and other awesome people. 😎 🤓 😇 😆

If you are taking a course that concentrates on data manipulation, ask the instructor nicely if they will include instruction of data.table along with the much slower dpliiiieeeeerrrr. You and your instructor will be amazed.

- Give me 100 random numbers and I’ll tell you 100 interesting things about them. (I.J. Good, maybe paraphrasing others, predicting the field of data science)

⭐⭐⭐⭐⭐

An easy fix if you’re analyzing time series (or teaching a class) is to (tell students to) do the following if they have been brainwashed into using dplyr. (You can also mention the benefits of learning data.table.)

# (1) either detach it

detach(package:dplyr)

# (2) or fix it yourself if you want dplyr

# this is a great idea from https://stackoverflow.com/a/65186251

library(dplyr, exclude = c("filter", "lag")) # remove the culprits

dlag <- dplyr::lag # and fix ...

dfilter <- dplyr::filter # ... the problems

# then use `dlag` and `dfilter` in dplyr scripts and

# `lag` and `filter` can be use as originally intended

# (3) or just take back the commands

filter = stats::filter

lag = stats::lag

# in this case, you can still use these for dplyr

dlag <- dplyr::lag

dfilter <- dplyr::filter

😖 If you are wondering how it is possible to corrupt a base package, 👽 you are not alone.

⭐⭐⭐⭐⭐

There is now dtplyr that uses data.table brains with dplyr interface. But, the problem with dplyr corruption still exists… so while this may be ok for people who want to take 100 random numbers and say 100 interesting things about them, it still poses a problem for the time series/signal processing people.

ISSUE - reproducibility

This is not just a time series complication but a problem for anyone trying to write stable code; i.e., code that not only works today, but also works next Sunday and maybe a year or two from now. The problem is that packages change - R changes 3 times a year.

This is not just a time series complication but a problem for anyone trying to write stable code; i.e., code that not only works today, but also works next Sunday and maybe a year or two from now. The problem is that packages change - R changes 3 times a year.

We’ve experienced both of the following problems, and it is agitating, agonizing, discomforting, disquieting, distressing, enraging, infuriating, maddening, and just plain annoying…

😡 Contributed Packages: For a little side interest, check out the isoband incident story where nearly 5000 packages were going to be removed from CRAN because of package dependencies.

-

Here’s what happened a long time ago. We used a contributed package in

astsa. An update to R broke the package with no easy way to fix the mess. We had to rewrite a number of scripts to circumvent problem. -

The advice for these kinds of problems is try not to rely on other packages if you only need a few items. Packages are open source, so if you need a script, find the source code at https://github.com/cran/, read the license (🤣), take what you need and modify it as necessary or use the script to write your own code, and credit the source.

😡 Vanilla R:

-

Recently, we started to work on something we did about a year ago. The code (in Vanilla R) doesn’t work anymore and gives several errors. After awhile, we realized that we did the work using Microsoft R version 4.0 (whereas Vanilla R was at version 4.2). So we went back to Micro R and voilà, no problems. We were able to figure out the problems eventually, but it made it much harder to restart the research.

-

Unfortunately, Microsoft R is dead. An alternative, however, Groundhog’s R Archive Neighbor Gran is available. More info here.

ISSUE - when is a matRix not a matRix?

You have a sequence of matrices, $A_t$, that are of ARBITRARY dimensions $p \times q$ for $t = 1, \dots, n$. You would use an

You have a sequence of matrices, $A_t$, that are of ARBITRARY dimensions $p \times q$ for $t = 1, \dots, n$. You would use an array right? BUT, and this is a big BUT, the behavior changes with $p$ and $q$. Let’s have a closer look:

# 3 2x2 matrices

( A = array(diag(1,2), dim=c(2, 2, 3)) )

, , 1

[,1] [,2]

[1,] 1 0

[2,] 0 1

, , 2

[,1] [,2]

[1,] 1 0

[2,] 0 1

, , 3

[,1] [,2]

[1,] 1 0

[2,] 0 1

is.matrix(A[,,2])

[1] TRUE ok - a matrix

but

# 3 2x1 matrices

( B = array(matrix(1,2), dim=c(2, 1, 3)) )

, , 1

[,1]

[1,] 1

[2,] 1

, , 2

[,1]

[1,] 1

[2,] 1

, , 3

[,1]

[1,] 1

[2,] 1

is.matrix(B[,,2])

[1] FALSE WTF? not a matrix

and

# 3 1x2 matrices

( C = array(matrix(2,1), dim=c(1, 2, 3)) )

, , 1

[,1] [,2]

[1,] 2 2

, , 2

[,1] [,2]

[1,] 2 2

, , 3

[,1] [,2]

[1,] 2 2

is.matrix(C[,,2])

[1] FALSE WTF? not a matrix

What’s happening is if $p$ or $q$ are $1$, then you don’t get an array of matrices. What can go wrong?

# should be a 2x1 times a 1x2 or 2x2 - BUT IT'S NOT!

B[,,1] %*% C[,,1]

[,1]

[1,] 4

# this doesn't work either

as.matrix(B[,,1]) %*% as.matrix(C[,,1])

Error in as.matrix(B[, , 1]) %*% as.matrix(C[, , 1]) :

non-conformable arguments

What’s the remedy? Use Matlab, or make sure your matrices are the matrices you intended them to be:

# like this

matrix(B[,,1], 2, 1) %*% matrix(C[,,1], 1, 2)

[,1] [,2]

[1,] 2 2

[2,] 2 2

😡 If you’re thinking Well don’t use array if one of the dimensions is 1, let me say that the dimensions are arbitrary… meaning if you write a general script, you have to have cases.

But wait … there’s more. A matrix should behave like a matrix, right? So if $A$ is a $3 \times 3$ matrix, what would happen if you tried to use $A_2$ instead of $A_{2,2}$? You would say you should get an error on misuse of subscripts to avoid errors in your code. And you would be correct, but you are using R … check it out:

But wait … there’s more. A matrix should behave like a matrix, right? So if $A$ is a $3 \times 3$ matrix, what would happen if you tried to use $A_2$ instead of $A_{2,2}$? You would say you should get an error on misuse of subscripts to avoid errors in your code. And you would be correct, but you are using R … check it out:

( A = matrix(1:9, 3) )

# [,1] [,2] [,3]

# [1,] 1 4 7

# [2,] 2 5 8

# [3,] 3 6 9

A[2,2]

# [1] 5 ok

A[2]

# [1] 2 WTF? this should be an error

str(A) # what seems to be going on

# int [1:3, 1:3] 1 2 3 4 5 6 7 8 9

😱 😱 😱

Issue - don’t use auto.arima

Don’t use black boxes like

Don’t use black boxes like auto.arima from the forecast package because they DON’T WORK.

Here are some related recent stories:

A.I.-Generated Reading List in Chicago Sun-Times Recommends Nonexistent Books

The summer reading list tucked into a special section of The Chicago Sun-Times and The Philadelphia Inquirer seemed innocuous enough.

There was just one issue: None of the book titles attributed to those authors were real. They had been created by generative artificial intelligence.

New York lawyers sanctioned for using fake ChatGPT cases in legal brief

A U.S. judge on Thursday imposed sanctions on two New York lawyers who submitted a legal brief that included six fictitious case citations generated by an artificial intelligence chatbot, ChatGPT.

Judge Rules in Favor of School That Gave Student a Bad Grade for Using AI

A federal judge has ruled that a Massachusetts school was likely within its rights to discipline a student who used generative artificial intelligence to complete an assignment.

Stanford Professor Accused of Using AI to Write Expert Testimony Criticizing Deepfakes

In what appears to be an embarrassing and ironic gaffe, a top Stanford University professor has been accused of spreading AI-generated misinformation while serving as an expert witness in support of a law designed to keep AI-generated misinformation out of elections.

👑 The obvious question in those stories is: Why wasn’t the generated material checked before submission??

🤔 Another obvious question is why are you using automated ARIMA fitting? If it’s because you don’t know what you’re doing, then how are you going to check the results before submission?

🙄 So what’s wrong with automated model fitting? Nothing … if you know what you are doing. And if you know what you are doing, and you want it to be automated for some reason, then it’s better to fit AR models because:

- the theory is well established and

- you don’t have to deal with the problem of cancellation of the AR and MA operators (aka parameter redundancy). Don’t know what that means?? Then don’t use automated ARIMA fitting because automated fitting doesn’t do this well, if at all (seems to me that programmers don’t address this).

- but, then there’s still the question of transformations:

- should you detrend?

- should you difference?

- should you fractionally difference?

- should you apply a variance stabilizing transformation?

- should you preprocess the data in any way before fitting a stationary model?

- and there’s the question of time-reversibility … does it seem the data are coming from a time-reversible (linear) process or perhaps a nonlinear model (not an ARMA) would be better

😵 If your answers to the above are: “I dunno,” then you should know that automated fitting doesn’t do any of these very well either.

😔 Well there are tests for some of these things, right??

- did you know that if the null hypothesis is true, the p-value is Uniform(0,1). That means if the null hypothesis is true, the p-value has the same probability of being bigger than .95 than less than .05.

- and if you automate a test, you have to choose a cut-off for a decision… do you reject the null if $p \le .05$ ?? well, what if $p=.051$ or $.052$ or … ?? 😵

👺 Originally, astsa (the first versions written in basic) had automatic fitting of models but IT DIDN’T WORK and was scrapped. The bottom line is, if you don’t know what you’re doing, then why are you doing it? Maybe a better idea is to take a short course on fitting ARIMA models to data. It’s really not that hard.

🤷 But what if I want to let a machine do it? Well, you’re better off fitting long ARs and try to deal with transformations in a smart way… at least you don’t have to check (approximate) overparameterization.

🐷 Here’s a simple example of automated ARIMA fitting to white noise:

set.seed(666)

x = rnorm(1000) # WHITE NOISE

forecast::auto.arima(x) # BLACK BOX

# partial output

Series: x

ARIMA(2,0,1) with zero mean

Coefficients:

ar1 ar2 ma1

-0.9744 -0.0477 0.9509

s.e. 0.0429 0.0321 0.0294

sigma^2 estimated as 0.9657: log likelihood=-1400

AIC=2808.01 AICc=2808.05 BIC=2827.64

HA! … an ARMA(2,1) ??

🐹 But if you know what you’re doing, you would realize the model that the auto.arima fit is overparameterized white noise.

It’s pretty obvious that the model is overparameterized white noise, but astsa has a way to check if you’re the type of person who has trouble with autostereograms.

arma.check(ar=c(-.9744,-.0477), ma=.9509)

# with output

The model is causal.

The model is invertible.

WARNING: (Possible) Parameter Redundancy

It looks like that ARMA model has (approximate) common factors.

This means that the model is (possibly) over-parameterized.

You might want to try again.

🐦 The bottom line here is, in it’s present state, automated ARIMA model fitting is for the birds. 🐦

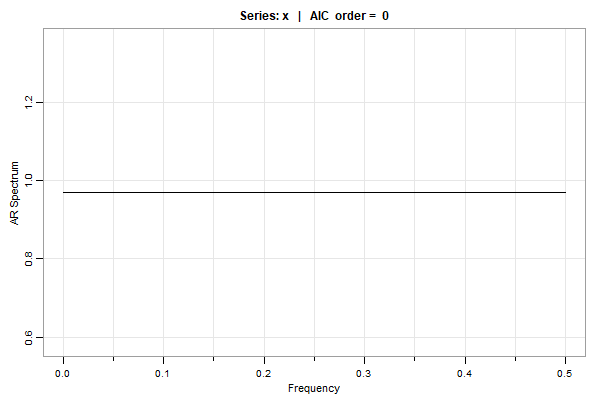

😈 So let’s see what happens if we just fit ARs using AIC

# we're going to use 'spec.ic' is from 'astsa'

library(astsa)

set.seed(666) # same as above

x = rnorm(1000)

u = spec.ic(x) # plot below

# to see the AICs and BICs (the min is sutracted so the min order is easy to find)

u[[1]]

ORDER AIC BIC

0 0.00 0.00

1 1.23 6.14

2 3.16 12.97

3 4.72 19.45

4 6.18 25.81

5 5.38 29.92

. . .

28 23.69 161.10

29 24.60 166.93

30 21.27 168.51

… it’s WHITE NOISE, dingus.

🤗 Here’s another one from the Time Series: A Data Analysis Approach text. Remember cmort, it’s weekly cardiovascular mortality in LA for a decade.

# first, using only 2% of our brain we find an ARIMA(1,1,0) model fits well ...

# it's Example 4.31 in the text if you want details:

sarima(cmort, 1,1,0)

# output

Coefficients:

Estimate SE t.value p.value

ar1 -0.5064 0.0383 -13.2233 0.0000

constant -0.0263 0.1715 -0.1533 0.8782

sigma^2 estimated as 33.809 on 505 degrees of freedom

AIC = 6.371023 AICc = 6.37107 BIC = 6.396044

🤨 Using auto.arima (which takes forever and gets my cpu fan racing)

forecast::auto.arima(cmort)

# output

ARIMA(2,0,2)(0,1,0)[52] with drift

Coefficients:

ar1 ar2 ma1 ma2 drift

0.5826 0.0246 -0.3857 0.2479 -0.0203

s.e. 0.3623 0.3116 0.3606 0.2179 0.0148 <- SEs are HUGE!!

sigma^2 = 56.94: log likelihood = -1566.28

AIC=3144.57 AICc=3144.76 BIC=3169.3

The final model is ARIMA $(2,0,2) \times (0,1,0)_{52}$. NONE of the parameters are significant at any reasonable level and the estimated standard errors are very large. And by seasonal differencing (which is NOT needed, you’ve lost more than 10% of the data).

😏 AIC, AICc, and BIC (comparable to the astsa output) are all worse than the use your brain model:

AIC = 6.895983 AICc = 6.896275 BIC = 6.950226 <- auto (arima)

AIC = 6.371023 AICc = 6.37107 BIC = 6.396044 <- brain (arima)

Also, you can specify the option to do an all subsets auto.arima - but for some reason, that’s worse than the stepwise (don’t ask me??)

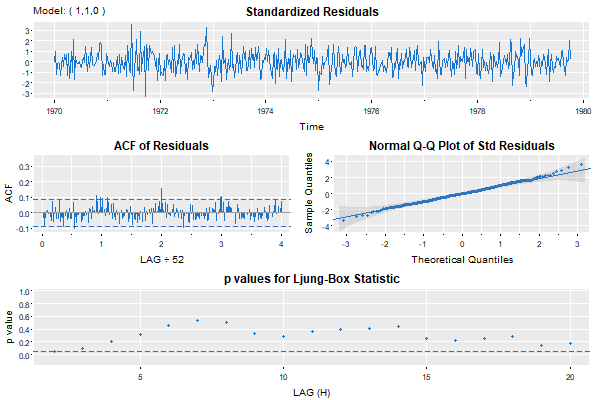

🤨 Wait a second… we’re not done because everyone knows you should do a residual analysis. Right? Right! First, the simple model:

That’s nice … maybe a little annual behavior still there, but small.

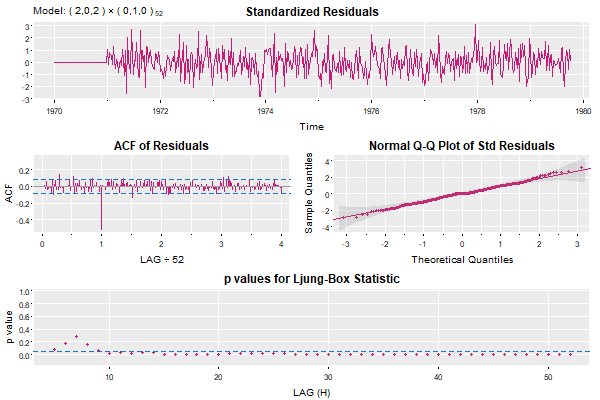

Now let’s look at the auto.ascreama residual analysis… look out below!

Ugly- isn’t it?

nuff said…

Issue - when is the intercept the mean?

When fitting ARMA models, Vanilla R calls the estimate of the mean, the estimate of the intercept. This is ok if there’s no AR term, but not if there is an AR term.

When fitting ARMA models, Vanilla R calls the estimate of the mean, the estimate of the intercept. This is ok if there’s no AR term, but not if there is an AR term.

For example, if $x_t = \alpha + \phi x_{t-1} + w_t$ is stationary, then taking expectations, with $\mu = E(x_t)$, we have $\mu = \alpha + \phi \mu$ or

\[\alpha = \mu (1-\phi).\]So, the intercept, $\alpha$ is not the mean, $\mu$, unless $\phi = 0$. In general, the mean and the intercept are the same only when there is no AR term. Here’s a numerical example:

# generate an AR(1) with mean 50

set.seed(666) # so you can reproduce these results

x = arima.sim(list(ar=.9), n=100) + 50

# in astsa it's

# x = sarima.sim(ar=.9, n=100) + 50

mean(x)

[1] 49.09817 # the sample mean is close

arima(x, order = c(1, 0, 0))

Coefficients:

ar1 intercept # <-- here is the problem

0.7476 49.1451 # <-- or here, one of these has to change

s.e. 0.0651 0.3986

The result is telling you the estimated model is something like

\[x_t = 49 + .75 x_{t-1} + w_t\]whereas, it should be telling you the estimated model is

\[x_t - 49 = .75 ( x_{t-1} - 49 ) + w_t\]or

\[x_t = 12.25 + .75 x_{t-1} + w_t\]🤔 And if $12.25$ is not the intercept, then what is it??

The easy thing (for the R devs) to do is simply change “intercept” to “mean”:

Coefficients:

ar1 mean # <-- easy

0.7476 49.1451

s.e. 0.0651 0.3986

This is the main reason sarima in the package astsa was developed, and frankly, to make up for the fact that time series was an afterthought, started the entire astsa package in the first place.

Here it is for your pleasure:

sarima(x,1,0,0)

# partial output

$ttable

Estimate SE t.value p.value

ar1 0.7476 0.0651 11.4835 0

xmean 49.1451 0.3986 123.3091 0

Issue - your arima is drifting

When fitting ARIMA models with Vanilla R, a constant term is NOT included in the model if there is any differencing. The best Vanilla R will do by default is fit a mean if there is no differencing [type

When fitting ARIMA models with Vanilla R, a constant term is NOT included in the model if there is any differencing. The best Vanilla R will do by default is fit a mean if there is no differencing [type ?arima for details].

What’s wrong with this? Well (with a time series in x), for example:

arima(x, order = c(1, 1, 0)) # (1)

will not produce the same result as

arima(diff(x), order = c(1, 0, 0)) # (2)

because in (1), Vanilla R will fit the model [with $\nabla x_s = x_s - x_{s-1}$]

\[\nabla x_t= \phi \nabla x_{t-1} + w_t \quad {\rm (no\ constant)}\]whereas in (2), Vanilla R will fit the model

\[\nabla x_t= \alpha + \phi \nabla x_{t-1} + w_t \quad {\rm (constant)}\]If there’s drift (i.e., $\alpha$ is NOT zero), the two fits can be extremely different and using (1) will lead to an incorrect fit and consequently bad forecasts.

If $\alpha$ is NOT zero, then what you have to do to correct (1) is use xreg as follows:

arima(x, order = c(1, 1, 0), xreg=1:length(x)) # (1+)

If you want to see the differences, generate a random walk with drift and try to fit an ARIMA(1,1,0) model to it. Here’s how:

set.seed(1) # so you can reproduce the results

v = rnorm(100,1,1) # v contains 100 iid N(1,1) variates

x = cumsum(v) # x is a random walk with drift = 1

## (1)

arima(x, order = c(1, 1, 0)) # yes! it's a mess!

# Coefficients:

# ar1

# 0.6031

# s.e. 0.0793

## (2)

arima(diff(x), order = c(1, 0, 0))

# Coefficients:

# ar1 intercept

# -0.0031 1.1163

# s.e. 0.1002 0.0897

## (1+)

arima(x, order = c(1, 1, 0), xreg=1:length(x))

# Coefficients:

# ar1 1:length(x)

# -0.0031 1.1163

# s.e. 0.1002 0.0897

Let me explain what’s going on here. The model generating the data is

\[x_t = 1 + x_{t-1} + w_t\]where $w_t$ is standard normal noise. Another way to write this is

\[x_t - x_{t-1} = 1 + 0 (x_{t-1} - x_{t-2}) + w_t\]or

\[\nabla x_t = 1 + 0 \nabla x_{t-1} + w_t .\]If you fit an AR(1) to $\nabla x_t$ [aka diff(x)], the estimates should be, approximately, ar1 = 0 and intercept = 1.

Thus (1) gives the WRONG answer because it’s forcing the regression through the origin. The others are correct.

Why does (1+) work? In symbols, xreg = t and consequently, Vanilla R will replace $x_t$ with $y_t = x_t - \beta t$ ;

that is, it will fit the model

or

\[\nabla [x_t - \beta t] = \phi \nabla [x_{t-1} - \beta (t-1)] + w_t.\]Simplifying,

\[\nabla x_t = \alpha + \phi \nabla x_{t-1} + w_t ,\]where $\alpha = \beta (1-\phi)$.

🐶 S-PLUS didn’t address the possibility that a time series would have drift. The R folks continued that mistake (mistakes propagate) because signal processing was an after-thought in S-PLUS that propagated to R. This oversight is easy to correct, why it isn’t corrected is a mystery.

🎉 The bottom line here is, if you wanna be happy for the rest of your life, don’t use Vanilla R for time series analysis. Instead, reach for a package like astsa that will set you free. 🎊

sarima(x,1,1,0)

# partial output

$ttable

Estimate SE t.value p.value

ar1 -0.0031 0.1002 -0.0308 0.9755

constant 1.1163 0.0897 12.4465 0.0000

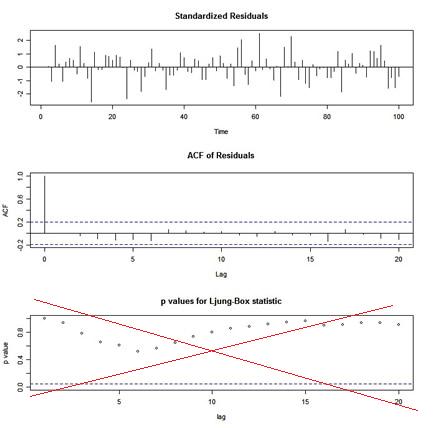

Issue - the wrong p-values

If you use Vanilla R’s

If you use Vanilla R’s tsdiag for diagnostics after an ARIMA fit, you will get a graphic that looks like this:

🤹🏻 The p-values shown for the Ljung-Box statistic plot are incorrect because the degrees of freedom used to calculate the p-values are lag instead of lag - (p+q). That is, the procedure being used does NOT take into account the fact that the residuals are from a fitted model. This is corrected in sarima in astsa.

Issue - lead from behind

You have to be careful when working with lagged components of a time series. Note that

You have to be careful when working with lagged components of a time series. Note that lag(x) is a FORWARD shift and lag(x,-1) is a BACKWARD shift (unless you happen to load dplyr).

Try a small example:

x = ts(1:5)

cbind(x, lag(x), lag(x,-1))

Time Series:

Start = 0

End = 6

Frequency = 1

x lag(x) lag(x, -1)

0 NA 1 NA

1 1 2 NA

2 2 3 1

3 3 4 2 ## in this row, x is 3, lag(x) is 4, lag(x,-1) is 2

4 4 5 3

5 5 NA 4

6 NA NA 5

In other words, if you have a series $x_t$ then

\[y_t = {\rm lag}\{x_t\} = x_{t+1}\]and NOT $x_{t-1}$. In fact, this is reasonable in that $y_t$ actually does “lag” $x_t$ by one time period. But, it seems awkward, and it’s not typical of other programs. As long as you know the convention, you’ll be ok (unless you happen to load dplyr).

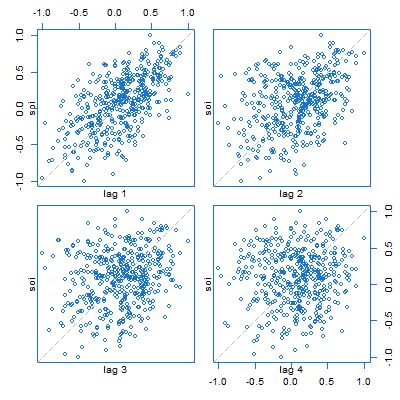

🐟 This plays out in many things with Vanilla R. For example, here’s a lag plot of the Southern Oscillation Index ($S_t$) series. It looks like scatterplots of $S_{t-k}$ (horizontal axis) vs $S_t$ (vertical axis), but in fact, are plots of $S_{t+k}$ vs $S_t$, for $k=1,\dots,4$.

lag.plot(soi, 4, col=4)

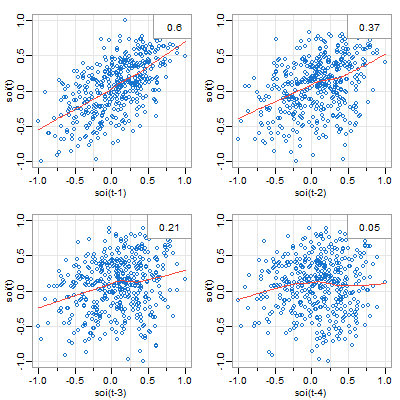

🐠 There are two lag plot scripts in astsa, here’s the (similar) one for one series. You get what you think you were getting in the plot above. And by default, you get a lowess fit (red line) and the sample ACF (top right).

lag1.plot(soi, 4, col=4)

Issue - regression nightmares

This is something you outta know. Although Vanilla R does warn you about this, it’s easy to miss. This is from the help file

This is something you outta know. Although Vanilla R does warn you about this, it’s easy to miss. This is from the help file ?lm near the end

Using time series

Considerable care is needed when usinglmwith time series.

If you are using lm() with time series, be sure to read the entire warning. We’ll just focus on one big problem via a little Vanilla R example.

set.seed(666)

y = 5 + arima.sim(list(order=c(1,0,0), ar=.9), n=20) # 20 obs from an AR(1) with mean 5

# in astsa it's

# y = 5 + sarima.sim(ar=.9, n=20)

# let's try to fit the regression using lm()

# first the regressor

x = lag(y,-1)

## you wouldn't regress y on lag(y) because that would be progress ;-)

# run the regression

lm(y ~ x)

Coefficients:

(Intercept) x

0 1

Perfect fit: $\hat y = x$ or $\hat x_t = x_{t-1}$.

But wait, we know $\hat x_t -5 = .9 (x_{t-1}-5)$ or $\hat x_t = .5 + .9 x_{t-1}$… must be a mistake.

The problem is that $x_t$ and $x_{t-1}$ aren’t aligned, so they look the same to Vanilla R. The remedy to is align them this way:

dog = ts.intersect(y, x) # aligns y and x on time

# the regession will work now

lm(y ~ x, data=dog)

Coefficients:

(Intercept) x

1.1011 0.7659

By the way, (Intercept) is used correctly here.

🐽 The bottom line for this one is, if x is a time series, x and lag(x,-1) [and any other version lag(x, k) for any integer k for that matter] are perfectly correlated unless you align them first.

🤣 Here you go

x1 = rnorm(100)

cor(cbind(x1, x2=lag(x1,-1), x3=lag(x1,3)))

# the correlation matrix (all 1s)

x1 x2 x3

x1 1 1 1

x2 1 1 1

x3 1 1 1

This can be a pain if you want to do lagged regressions, say

\[x_t = \beta_0 + \beta_1 z_{t} + \beta_2 z_{t-1} + w_t\]because all those series have to be aligned first: dog = ts.intersect(x, z, lag(z,-1)). And then if you want to try another lag of z, you have to redo dog. Luckily, there is a package called dynlm that can handle these problems without having to align and re-align. The nice thing is it works like lm.

Issue - Yu-Gi-El Why?

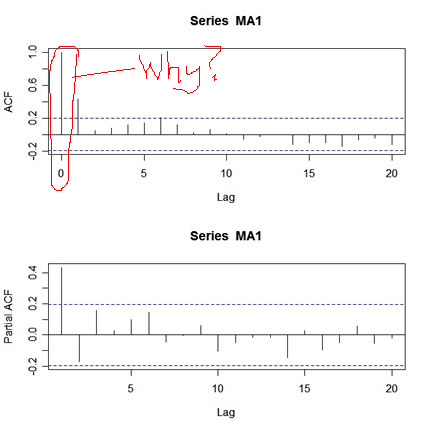

U - G - L - Y … you ain’t got no alibi. This was one of the first things we took care of in astsa. When you’re trying to fit an ARMA model to data, you first look at the sample ACF and PACF of the data.

U - G - L - Y … you ain’t got no alibi. This was one of the first things we took care of in astsa. When you’re trying to fit an ARMA model to data, you first look at the sample ACF and PACF of the data.

Let’s try this for a simulated MA(1) process. Here’s how

MA1 = arima.sim(list(order=c(0,0,1), ma=.5), n=100)

# in astsa it's

# MA1 = sarima.sim(ma=.5, n=100)

par(mfcol=c(2,1))

acf(MA1,20)

pacf(MA1,20)

and here’s the output:

What’s wrong with this picture? First, the two graphs are on different scales. The ACF axis goes from -.2 to 1, whereas the PACF axis goes from -.2 to .4. Also, the lag axis on the ACF plot starts at 0 (the 0 lag ACF is always 1 so you have to ignore it or put your thumb over it), whereas the lag axis on the PACF plot starts at 1. So, instead of getting a nice picture by default, you get an UGLY messy picture.

You can fix it up:

par(mfrow=c(2,1))

acf(MA1, 20, xlim=c(1,20)) # set the x-axis limits to start at 1 then

# look at the graph and note the y-axis limits

pacf(MA1, 20, ylim=c(-.2,1)) # then use those limits here

But an easier thing to do is to use acf2 from the astsa package.

Issue - Do Not Run This Example

❌ After viewing enough help files, you will eventually run into ## Not run: in an Examples section. Why would an example be given with a warning NOT to run it?

Not run just tells CRAN not to check the example for various reasons such as it takes a long time to run … it sort of runs against the idea that help files should be helpful or at least not make things worse. Bottom line: Ignore it. It is NOT for a user's consumption. If you are using html help and you see this, then Run Examples will not do anything. In this case, you just copy-and-paste the code to run it (at your own risk of course).

If you are using html help and you see this, then Run Examples will not do anything. In this case, you just copy-and-paste the code to run it (at your own risk of course).

🐒 𝔼 ℕ 𝔻 🐒